Oracle Apps R12 OPM, SCM, INV, Procurement, OM Modules Functional and Technical Solution by Razaul Karim Reza

Translate

Monday, March 27, 2017

PROD_Batch_ Status_Query

SELECT o.ORGANIZATION_CODE, o.ORGANIZATION_NAME, o.ORGANIZATION_ID,

gbh.BATCH_NO,decode(gbh.BATCH_STATUS,3,'Completed') Batch_Status

FROM GME_BATCH_HEADER gbh,

ORG_ORGANIZATION_DEFINITIONS o

WHERE CREATION_DATE between TO_DATE('01-Feb-2017','DD-MM-YYYY') and TO_DATE('28-Feb-2017','DD-MM-YYYY')

AND gbh.ORGANIZATION_ID=o.ORGANIZATION_ID

ORDER BY BATCH_STATUS, o.ORGANIZATION_CODE

Oracle EBs Apps Blog of Mahfuz, OPM Consultant, Bangladesh.

http://mahfuzgeml.blogspot.com/2015/12/opm-formula-to-execution-work-flow.html

Sunday, June 12, 2016

Defining Resource Cost in Oracle Process Manufacturing (OPM) # Defining Fixed Overheads in Oracle Process Manufacturing (OPM) # How to open new period in OPM Cost Calendar? # Subledger Accounting Balances Update # OPM Cost Allocation Process # Setting up default value of Create Accounting mode as “Draft” (Process Manufacturing Financial) #

Defining Resource Cost in Oracle Process Manufacturing (OPM)

To

reflect the cost of the resource incurred during production in the

product cost, set up routings and define the amount or number of

resources used.

Outside

production, set up overheads to reflect the amount of resources other

than the production or ingredients used in the product; you can then

include overhead costs in the cost of producing the product. In either

case, first we must define nominal usage cost associated with the

resource.

To know about defining Overheads, click the following link

Pre-requisites:

Resources

To know about how to define a resource, click the following link

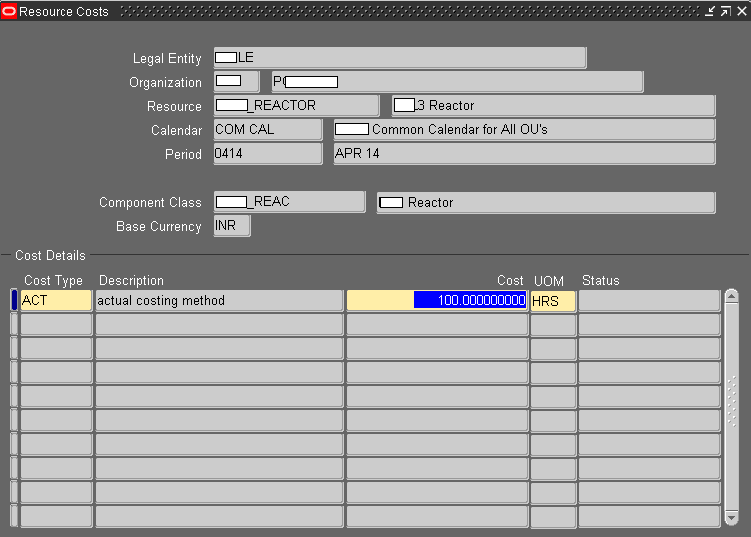

Navigation: OPM Financials > Resource costs

Enter the code of the Organization for which this resource cost is effective.

Note: If

Organization is not entered then the resource cost will be considered

for all the organizations that fall under the displayed Legal entity.

Enter the Resource for which we are defining the cost.

Enter the Cost Calendar & Period for which this resource cost will be applicable.

Component class displays the component class associated with the resource & Base Currency displays the legal entity’s base currency.

Cost Details

Enter for which Cost Type this resource cost is defined.

Enter a Nominal Cost for the resource for using it for one unit of measure. For example,

if you are defining the resource cost for a mixing machine, and its

usage is measured in hours, then enter the cost of using the mixing

machine for one hour.

Enter the unit of measure in which usage of this resource is measured in UOM.

By default the system will display the unit of measure initially

defined for this resource. We can edit the value within the same unit of

measure class.

Note: Status field is not applicable

---X---

Defining Fixed Overheads in Oracle Process Manufacturing (OPM)

An overhead is a cost associated with a resource other than the resource usage assigned in the routing.

Assume

you need a laborer to clean MIXER after each use. To account for the

cost of cleanup, instead of adding another component cost to each item

that uses MIXER, you can assign an overhead to the items being produced

by that laborer on MIXER. The overhead assignment would be the time it

takes the laborer to clean MIXER multiplied by the cost per hour for the

laborer.

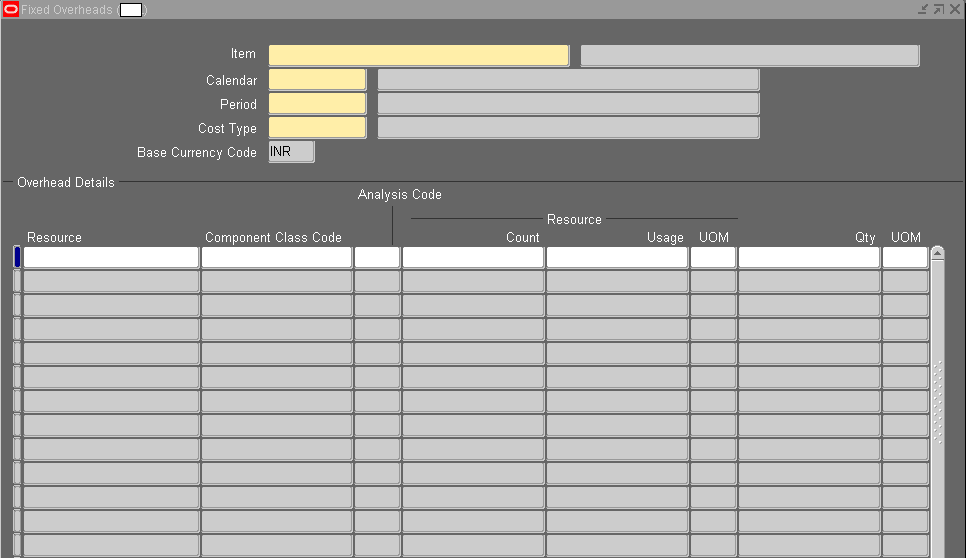

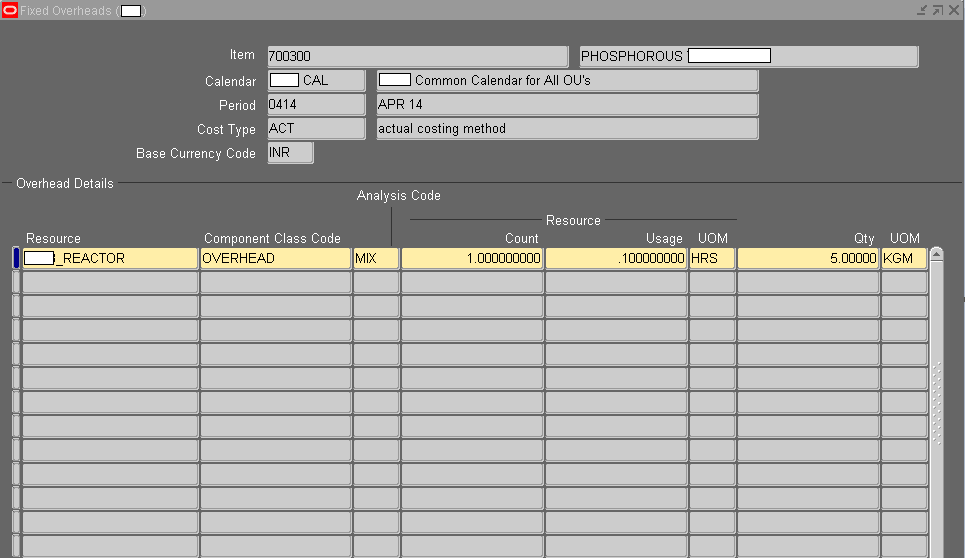

Navigation:

OPM Financials > Fixed Overheads

To define Fixed Overheads:

Enter the Item code to which this overhead is going to assigned.

Enter a valid Calendar, Period code & Cost type.

Base Currency code field will display the base currency of the legal entity.

Overhead Details:

Enter the Resource code and Component Class code.

To know how to create a Resource click the following link http://dj-oracleapps.blogspot.in/2014/02/creating-resources-in-oracle-process.html

To know how to create a Resource click the following link http://dj-oracleapps.blogspot.in/2014/02/creating-resources-in-oracle-process.html

Enter the Analysis code under which this overhead should appear in cost detail.

Enter the Qty of resource used in the production of this item in Resource Count. Ex: If it takes one worker to cleanup Mixer after each use, then enter 1. This number is multiplied by the Resource Usage to calculate the total resource usage.

Enter the amount of the resource used for this overhead in Resource Usage. Ex: If it takes 10 minutes for a worker to cleanup Mixer after each use, then enter 0.10

Enter the unit of measure in which the resource is yielded in Resource UOM.

Enter the amount of the item yielded in this production process during the entered .10 hours of resource usage in Item Quantity.

Enter the unit of measure in which this overhead is measured in Overhead UOM field.

---X---

How to open new period in OPM Cost Calendar?

Navigation: OPM Financials > Setup > Cost Calendars

Query the calendar which you use

In the new line enter the Period code, Description & End Date of the period & click ‘Assignments’.

Click on the cost type you are using and click ‘Period Status’ tab.

By default the status of the new period will be ‘Never Opened’.

Click the ‘lov’ and change the status to “Open”.

---X---

Subledger Accounting Balances Update

In this post we will see what Subledger accounting balances update concurrent is & what it does?

The

Subledger Accounting Balances Update is a standalone concurrent program

which calculates the control balances and analytical balances

(supporting reference balances) for any newly accounted transactions.

Normally,

Create Accounting and online accounting will automatically call the

Subledger Accounting Balances Update program to calculate the

control/analytical balances. However, there have been situations where

multiple online accounting programs are called simultaneously, and if

all of them have accounts which belong to either control accounts or

analytical accounts then only one of the simultaneous online accounting

programs will be successful in updating the balances.

To

ensure that balances are up to date, it is recommended that you

manually run the Subledger Accounting Balances Update program for the

ledger at least once before you run the Third Party Balances report or

before viewing Supporting Reference Balances. This is to ensure that all

balances are updated completely.

---X---

OPM Cost Allocation Process

In this post we will see what exactly OPM Cost Allocation Process concurrent does and how to run it.

OPM

Cost Allocation process concurrent takes care of spreading the costs

down to the products as defined in Allocation definitions form.

Parameters:

Legal Entity – Enter your LE

Cost Calendar – Enter the name of your calendar

Period – Enter the period for which the cost has to be allocated.

Cost Type – Enter the costing method which you use.

Fiscal year – Fiscal year

Period – This refers to GL Period

Allocation From - Enter the from allocation code

Allocation To - Enter the to allocation code

Refresh Interface – Yes / No

In the new form enter your Ledger Name and click go.

---X---

Setting up default value of Create Accounting mode as “Draft” (Process Manufacturing Financial)

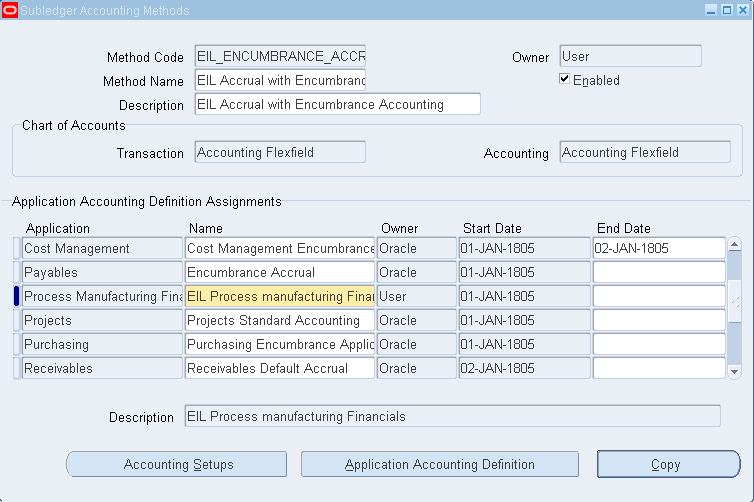

Navigation:

OPM

Financial Responsibility – Setup – Subledger Accounting setups –

Accounting Methods Builder – Methods and definitions – Subledger

Accounting methods.

Query on user defined Subledger accounting method

Keep the cursor on application “Process Manufacturing Financials” & Click “Accounting Setups”.

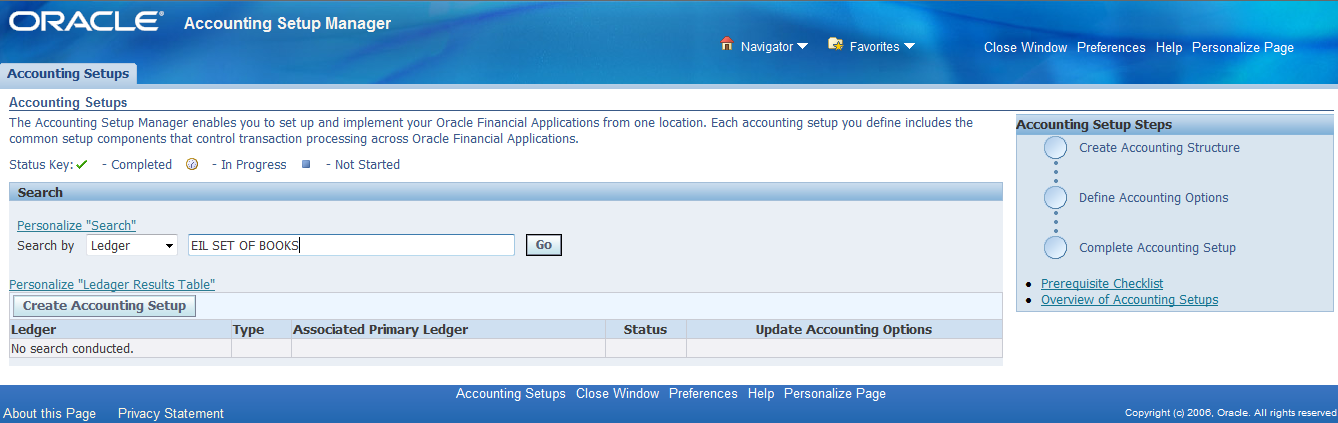

In the new form enter your Ledger Name and click go.

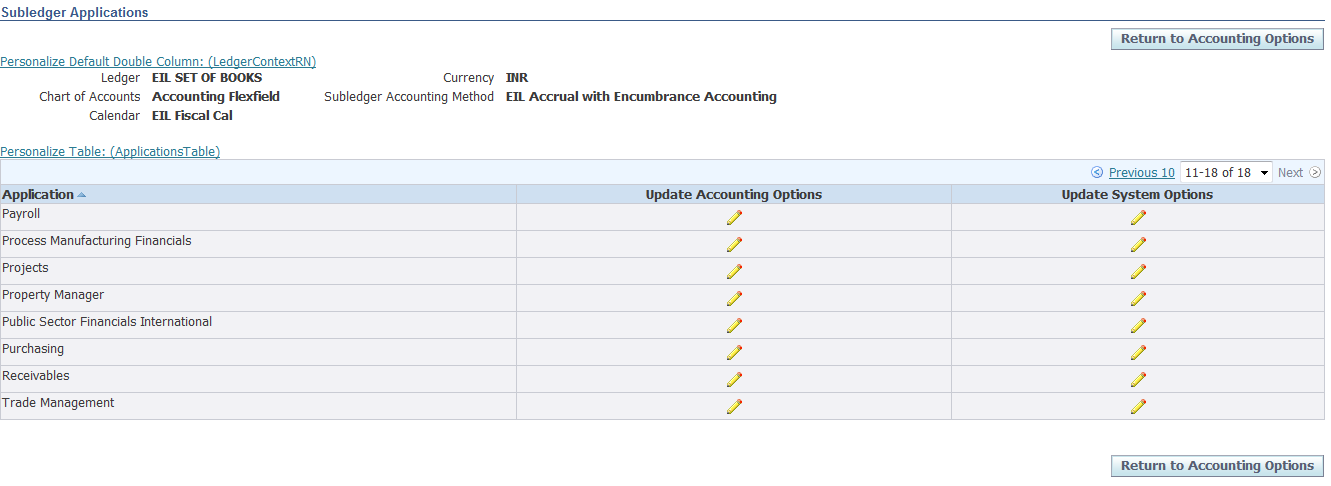

Click “Update Accounting options” against your Ledger.

Click on “Update” button against “Subledger accounting options” Setup step

In the list of options click “Update Accounting options” against “Process Manufacturing Financials” Application

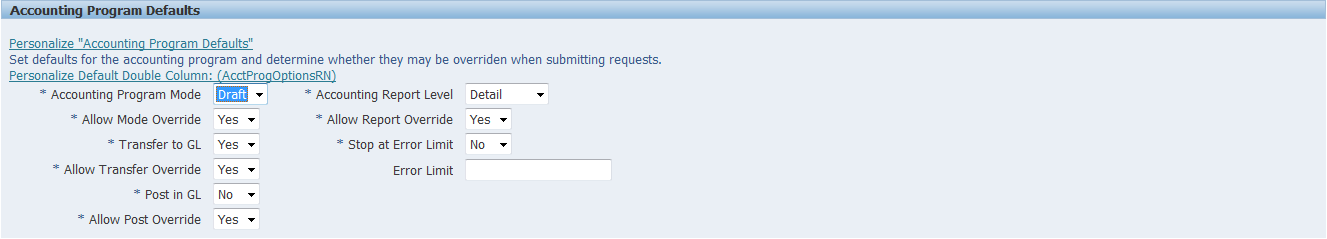

In the “Accounting Progam Mode” select “Draft”. Click on Apply button.

By following the above steps, we can define the default value of create accounting program as “Draft”.

---X---

Oracle Process Manufacturing(OPM), Actual Cost Adjustments in Oracle R12, Defining Adjustment Reason Codes in Oracle R12, Defining Cost Analysis Codes in Oracle R12, Defining Resource Cost in Oracle Process Manufacturing (OPM), Defining Fixed Overheads in Oracle Process Manufacturing (OPM)

Actual Cost Adjustments in Oracle R12

Actual

Cost adjustment allows us to adjust the final calculated cost of a raw

material or product based on quantity and unit cost.

Navigation:

OPM Financials > Actual costs > Adjustments

Enter the Item for which the cost should be adjusted. This may be a raw material, co-products, by-product, intermediate, or product.

Enter the Cost Calendar to which the adjusted actual costs for the item will be updated.

Enter a Period within the cost calendar to which the adjusted actual costs for the item will be updated.

Cost Type must be an actual cost type.

Item cost field will display the current cost of the Item.

Actual Cost Adjustment Details:

The Actual Cost Adjustment supports three adjustment types,

- Average Cost adjustment

- Value Cost adjustment

- Unit cost adjustment

Average Cost Adjustment:

The

Average Cost Adjustment type lets us to enter a quantity and a cost.

This adjustment simulates a transaction that happened outside the OPM

Actual Cost process. For example, if you use a third party system to

record transactions, then use this adjustment type to replicate the

event to include in cost calculations. The Actual Cost process considers

these transactions similar to a purchase order receipt.

(Prior Qty * Prior cost) + Sum of (Receipt qty * PO price) + Average cost adjustments

New unit cost = --------------------------------------------------------------------------------------------------------

(Prior Qty + Sum of Receipt Qty + Sum of average Cost adjustment Qty)

Value Cost Adjustment:

The

Value Cost adjustment allows us to enter an adjustment value without

quantity. The value entered will be considered for the entire quantity.

(Prior Qty * Prior cost) + Sum of

(Receipt qty * PO price) + Value adjustments

New unit cost = -------------------------------------------------------------------------------------------------

(Prior Qty + Sum of Receipt Qty)

Unit Cost Adjustment:

Unit

Cost Adjustment type lets us to adjust the actual unit cost of the item

with the specified cost. The Actual Cost process calculates the cost of

the item as per the current logic and then applies this unit cost

adjustment to calculate the new adjusted cost. This adjusted cost

becomes the new actual cost of the item.

First the New unit cost (without the Unit cost adjustment) is calculated as follows,

(Prior Qty * Prior cost) + Sum of (Receipt qty * PO price) +

New unit cost Value adjustments + Average Cost adjustments

(without Unit Cost = ---------------------------------------------------------------------------------------

Adjustments) (Prior Qty + Sum of Receipt Qty + Sum of Average Cost adjustment Qty

The

Unit Cost Adjustment is included only after the Actual Cost is

calculated based on the existing Adjustment types. Then, the New Unit

Cost (with the Unit Cost Adjustment) is calculated as follows,

New unit cost (with Unit Cost Adjustments) = New unit cost (without unit cost adjustments) + Unit cost Adjustments

After selecting the type enter the Component Class code being adjusted. To know about defining Component Class click the following link

http://dj-oracleapps.blogspot.in/2014/07/defining-cost-analysis-codes-in-oracle.html

Enter Quantity of the item, if the type is Average Cost Adjustment.

Enter the Unit of Measure

in which the specified item's actual costs are being adjusted in UOM.

This can be any unit of measure that can be converted to the item's unit

of measure.

Specify the new Unit Cost for the item in this inventory organization, calendar and period.

Enter the Reason Code

that defines the reason behind the actual cost adjustment you are

making. To know how to define Reason Code’s click the following link,

Click the Subledger Entry to choose whether a subledger entry should be created for the adjustment.

Note:

Based on the Reason Code

selected, the Subledger Entry defaults what was selected for the

adjustment reason code. For example, if the specified adjustment reason

code was selected as a reason code with the Subledger Entry option

enabled on the Actual Cost Adjustment Codes window, then this field is

automatically enabled.

GL Date

Indicates the GL transaction date used by the Accounting process for

creating accounting entries for adjustments. If the Subledger Entry

option is selected, then the GL Date is enabled and defaults to the

start date of the selected calendar and period. If the Subledger Entry

option is not selected, then the GL Date is disabled and the date is set

to Null.

One of the following three statuses of the costing adjustment displays automatically in Adjustment Status,

- Not Applied - This is the initial status applied to the adjustments

- Applied - This indicates that the adjustments have been "picked up" by the Actual Costing process and have been used in the cost calculation.

- Modified - This indicates that the adjustments have been modified after they have been applied to actual costs.

---X---

Defining Adjustment Reason Codes in Oracle R12

If

there is a need to adjust actual costs calculated by OPM, then use the

Actual Costs Adjustments to enter the adjustment costs. We must specify a

valid reason code to justify the reason for the cost change.

Navigation: OPM Financials > Setup > Actual Costs > Adjustment Reasons

Enter a Code that explains the reason for adjusting the actual cost calculation for a raw material or a product.

Enter a brief Description of the reason.

Enable the Subledger Entry check box to indicate whether to book the adjustment to subledger or not.

---X---

Defining Cost Analysis Codes in Oracle R12

An

individual component cost identified by a particular cost component

class can be further broken down using cost analysis codes for more

granular tracking of costs. The cost analysis codes are used to group

component costs from multiple cost component class types to provide an

alternate view of the total cost.

Navigation: OPM Financials > Setup > Analysis Codes

Enter the Code to identify the cost analysis type.

Enter a Description for the analysis code.

---X---

Defining Resource Cost in Oracle Process Manufacturing (OPM)

To

reflect the cost of the resource incurred during production in the

product cost, set up routings and define the amount or number of

resources used.

Outside

production, set up overheads to reflect the amount of resources other

than the production or ingredients used in the product; you can then

include overhead costs in the cost of producing the product. In either

case, first we must define nominal usage cost associated with the

resource.

To know about defining Overheads, click the following link

Pre-requisites:

Resources

To know about how to define a resource, click the following link

Navigation: OPM Financials > Resource costs

Enter the code of the Organization for which this resource cost is effective.

Note: If

Organization is not entered then the resource cost will be considered

for all the organizations that fall under the displayed Legal entity.

Enter the Resource for which we are defining the cost.

Enter the Cost Calendar & Period for which this resource cost will be applicable.

Component class displays the component class associated with the resource & Base Currency displays the legal entity’s base currency.

Cost Details

Enter for which Cost Type this resource cost is defined.

Enter a Nominal Cost for the resource for using it for one unit of measure. For example,

if you are defining the resource cost for a mixing machine, and its

usage is measured in hours, then enter the cost of using the mixing

machine for one hour.

Enter the unit of measure in which usage of this resource is measured in UOM.

By default the system will display the unit of measure initially

defined for this resource. We can edit the value within the same unit of

measure class.

Note: Status field is not applicable

---X---

Defining Fixed Overheads in Oracle Process Manufacturing (OPM)

An overhead is a cost associated with a resource other than the resource usage assigned in the routing.

Assume

you need a laborer to clean MIXER after each use. To account for the

cost of cleanup, instead of adding another component cost to each item

that uses MIXER, you can assign an overhead to the items being produced

by that laborer on MIXER. The overhead assignment would be the time it

takes the laborer to clean MIXER multiplied by the cost per hour for the

laborer.

Navigation:

OPM Financials > Fixed Overheads

To define Fixed Overheads:

Enter the Item code to which this overhead is going to assigned.

Enter a valid Calendar, Period code & Cost type.

Base Currency code field will display the base currency of the legal entity.

Overhead Details:

Enter the Resource code and Component Class code.

To know how to create a Resource click the following link http://dj-oracleapps.blogspot.in/2014/02/creating-resources-in-oracle-process.html

To know how to create a Resource click the following link http://dj-oracleapps.blogspot.in/2014/02/creating-resources-in-oracle-process.html

Enter the Analysis code under which this overhead should appear in cost detail.

Enter the Qty of resource used in the production of this item in Resource Count. Ex: If it takes one worker to cleanup Mixer after each use, then enter 1. This number is multiplied by the Resource Usage to calculate the total resource usage.

Enter the amount of the resource used for this overhead in Resource Usage. Ex: If it takes 10 minutes for a worker to cleanup Mixer after each use, then enter 0.10

Enter the unit of measure in which the resource is yielded in Resource UOM.

Enter the amount of the item yielded in this production process during the entered .10 hours of resource usage in Item Quantity.

Enter the unit of measure in which this overhead is measured in Overhead UOM field.

---X---

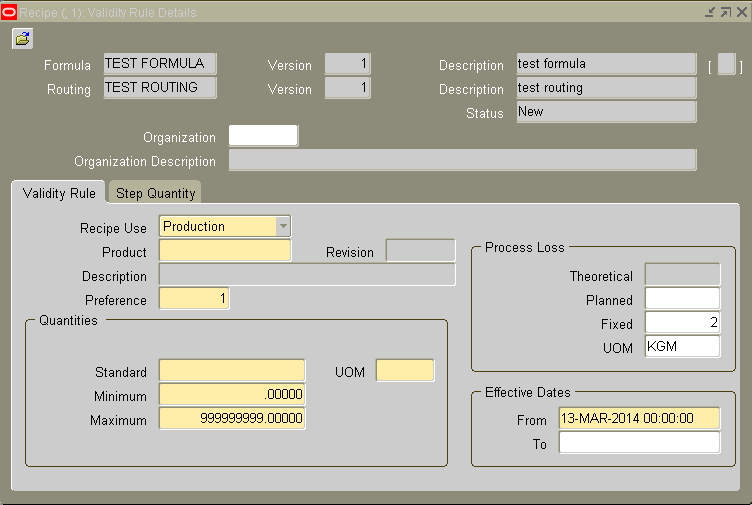

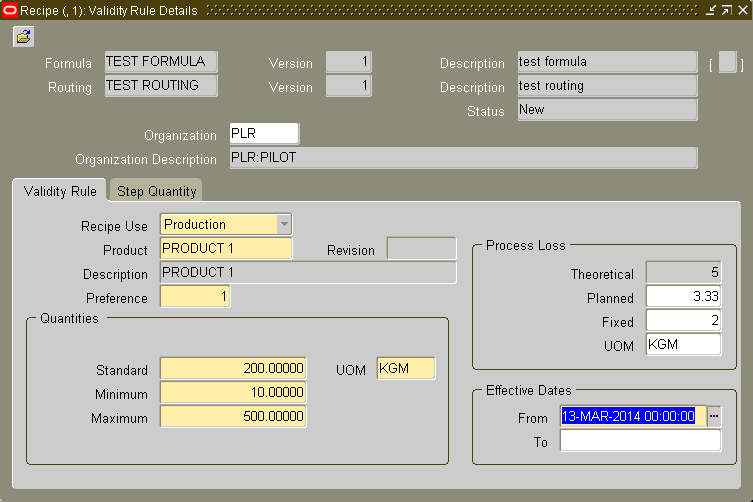

Setting up Validity rules for Recipe in Oracle Process Manufacturing (OPM)

By

using Validity Rules an organization can set the standard quantity and

effective dates of a recipe to specify what, where, when, and how

formulas, recipes, routings, and operations must be applied.

Prerequisite:

- Recipe

To know how to create a recipe, click the following link.

Navigation: Process Engineer > Recipes

Query the recipe for which the validity rule is going to be set & Click Validity Rules tab.

Enter the Organization that owns this Validity rule.

Validity Rule

Select Recipe Use as,

- Production for use in production of products.

- Planning for use in planning material consumption.

- Costing for use in establishing costs.

- Regulatory for use with hazardous or controlled materials.

- Technical for use in establishing technical classes and subclasses.

Enter a Product in the formula for the validity rule.

Enter the Preference

number for the validity rule. When more than one formula can be used to

produce the same product, this field indicates the validity rule that

must be used first, second and so forth.

Enter the Standard Quantity

of product made with the formula. This quantity is only used for

product costing. It does not restrict quantities that can be produced

with the formula.

Enter the Minimum Quantity of product that can be made using the Formula.

Enter the Maximum Quantity of product that can be made using the formula.

Theoretical displays the theoretical process loss based on the Validity Rule Standard Quantity.

Enter Planned Process Loss. This overrides planned process loss entered at the routing level.

Enter Fixed Process Loss. This value is defaulted to the value you entered in the Recipe Details window. If required, we can override this value.

Enter From date

as the date the validity rule becomes effective. The date must be

within the effective date for any routing associated to the recipe.

Enter To date

as the date to stop using the validity rule. If an expiration date is

not defined for the validity rule, then this is an optional field and

must be left blank.

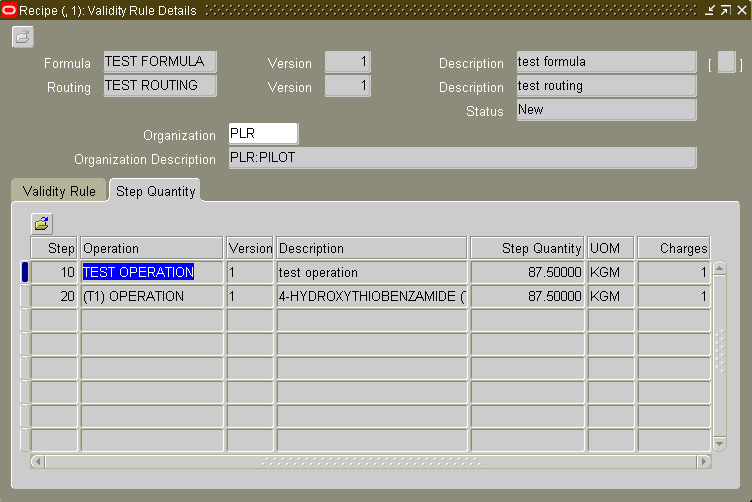

Step Quantity

The fields are view only.

Operation associated to the step will be displayed.

Step Quantity and its UOM indicate the quantity processed by the routing step and the unit of measure of the step quantity.

Now

a validity rule is set for this Recipe. The system will not allow us to

create a batch with this recipe, even if any one of the condition in

the validity rule fails.

Note:

A

validity rule cannot be approved for general use until its associated

recipe is approved for general use. We can change the status of recipes

or validity rules to on-hold or obsolete even if they are used in

batches as long as all the batches are closed or canceled.

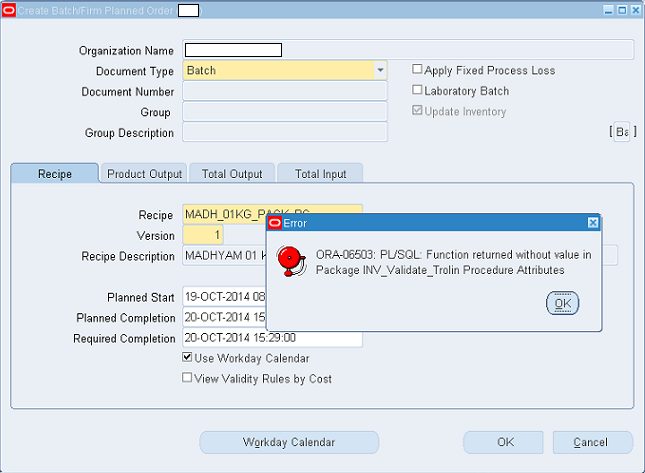

ORA-06503: PL/SQL Function returned without value in Package INV_Validate_Trolin Procedure Attributes

When trying to create a new batch, following error is occurring:

ORA-06503: PL/SQL Function returned without value in Package INV_Validate_Trolin Procedure Attributes

Cause:

The

issue is occurring when, an item is used in the formula with an UOM

that is neither primary or secondary item UOM and there is no conversion

defined between the formula UOM and primary or secondary UOM.

Solution:

Check

whether wrong UOM is entered mistakenly in Formula. If UOM’s were

entered as required then define correct UOM conversions for items used

in formula.

---X---

===X===

Subscribe to:

Comments (Atom)

Item Rate Update for Stock In Trade - Returnable Receive/Return (Loan)

Stock In Trade - Returnable Receive/Return (Loan)

-

Oracle Apps R12 Subledger Accounting Tables and joins XLA Table joins GL_JE_BATCHES (je_batch_id) => GL_JE_HEADERS...

-

Stock In Trade - Returnable Receive/Return (Loan)

-

Oracle Alert : Move order Created from Production Batch I Got one Requirement from Production and Store Team, as below So I created...